How to stay broke

It is not helpful or productive to think about ways to stay broke, as poverty can be difficult and challenging condition that can have negative impacts on a person’s quality of life and overall well-being.

However, you can learn just as much from broke people as you can from the wealthy.

The thing you are after and the opposite are highly related. Do not overlook the lessons you can learn from broke people.

Read More

What financial goals should over 60s be making?

What financial goals should over 60s be making?

Our Newcastle Financial Planners provide their advice and tips to setting goals in your 60s.

Read More

Ten financial mistakes to avoid when retiring

How do you retire on your terms and avoid making financial mistakes when retiring?

Our financial planners discuss the top ten financial mistakes to avoid when retiring.

Read More

Setting goals for 2023

Start making your goals today and see where they take you tomorrow.

Our financial planners discuss how to set goals, why goals are important, why setting goals can be difficult and how a financial planner can support you in setting your goals and putting a plan in place to achieve your goals.

Read More

Why see a financial planner?

Why see a financial planner?

Read More

Safe as houses

Is property “as safe as houses” ?

Our Newcastle financial planners provide a quick update on the property market.

Read More

Why should you use superannuation as a retirement savings vehicle?

Why should you use superannuation as a retirement savings vehicle?

Read More

How does inflation affect my investments?

How does inflation affect my investments?

Read More

Retirement Planning

What is retirement planning? And why consider retirement planning?

What is the right age to retire in Australia?

Read More

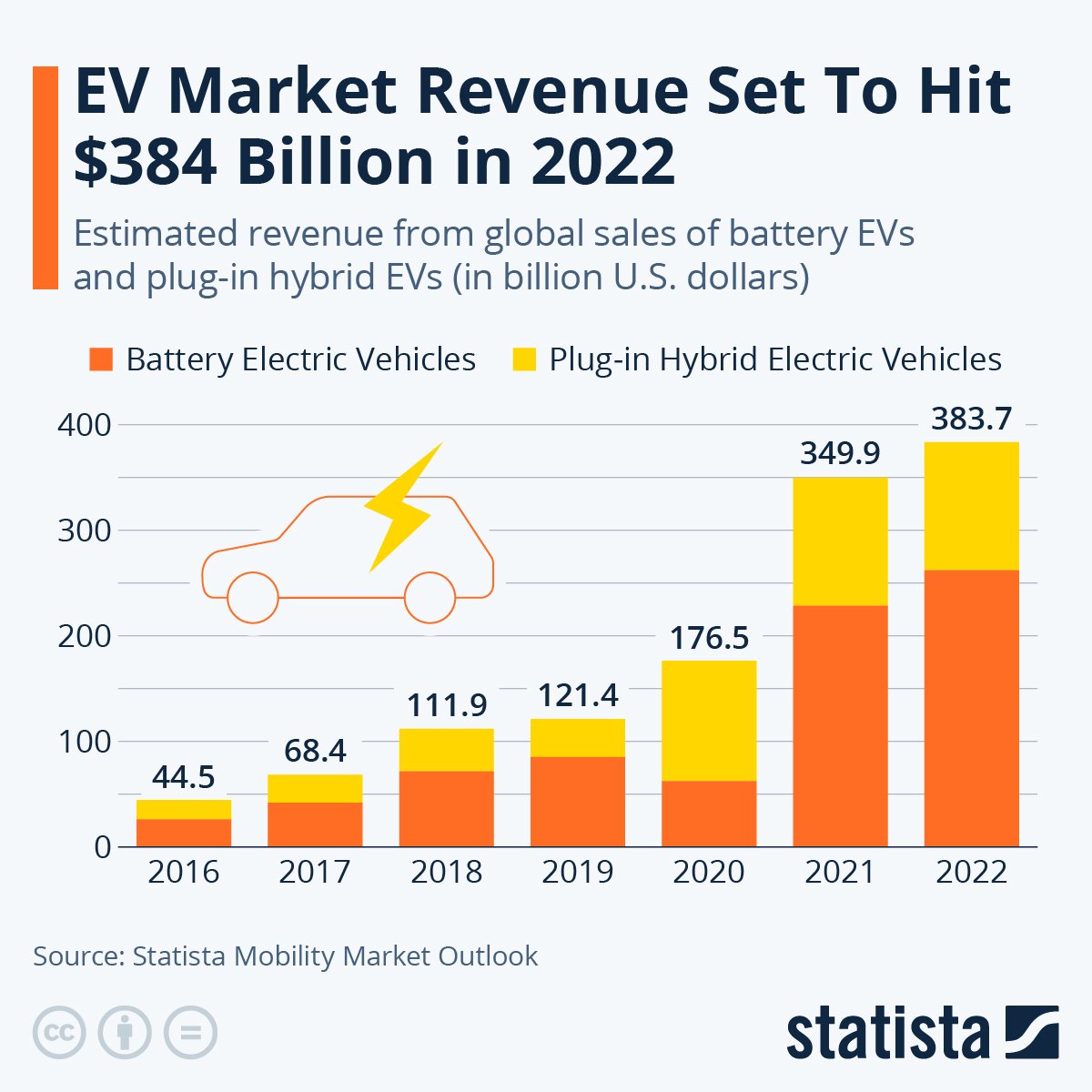

Tesla

Are you looking for exposure to the Electric Vehicle industry? Or are you considering investing in Tesla?

Read More

Sydney property prices down 10% from record highs

Sydney property prices down 10% from record highs.

Hear from our Newcastle Financial Planners about what is happening with inflation, interest rates and what is next for property prices.

Read More

Australian share market soars 50 billion dollars

Australian shares are set to soar at the open after a better than expected US October consumer price report, which has been bolstered by bets that the Federal Reserve will step down its rate rise pace.

The S&P rose 5.54% overnight, with the Aussie market pointing to an early rise of 2.88%.

Read More

Three steps to feel more in control when retiring

Three steps to feel more in control in retirement.

For many looking to retire, a mix of health concerns, market volatility, rising cost of living and employment disruptions over the past two years have raised more concerns around when is the right time to retire. Our Newcastle Financial Planners outline three steps to feel more in control when retiring.

Read More

Anna Bay mum wins $33 million lotto

What to do If you win the lotto?

Most people have no idea how much money they will need to achieve financial security, independence and freedom. The giant numbers in their head are so intimidating that they never even start a plan to get there.

Read More

Always be bigger than your money.”

Always be bigger than your money.

I think the best explanation for this quote is if we allow money to stir emotions of anger, greed, fear, or even joy, in that moment, we have allowed money to become bigger than ourselves.

We have become money’s servant.

Read More

Retirement planning - it's not all about the money

Retirement is not all about money.

Retirement is often a massive life change for the majority of people who experience it. Most of us will have mixed emotions around the end of our working life and the beginning of our 'second half'. For some it will be a relief, and something they have long planned for and are looking forward to, but for others it will be a source of anxiety.

Read More

How Do Rising Interest Rates Impact Your Borrowing Capacity?

Interest rate increases have decreased people’s borrowing capacity.

What impact does this have on property prices?

Read More

Is the world going to explode?

Is the world going to explode?

This is the view of some investment experts, if the Fed were to announce a 1% rate hike this evening.

Read More

Age Pension Increase

Our Newcastle Financial Planners discuss the recent increases to the Age Pension, how this may affect you and when is it time to review your retirement plan?

Read More

Market Update - September

Our Newcastle Financial Planners provide a market update and provide insights into what is next for the economy and how you can position your portfolio to take advantage of the opportunities.

Read More