Tesla

Tesla

We had a client recently ask about investing in Tesla. We are not a pure investment advisor and we do not provide research on individual stocks as we prefer to use expert stock brokers in this field. However, we wanted to share some of the information we discussed with the client.

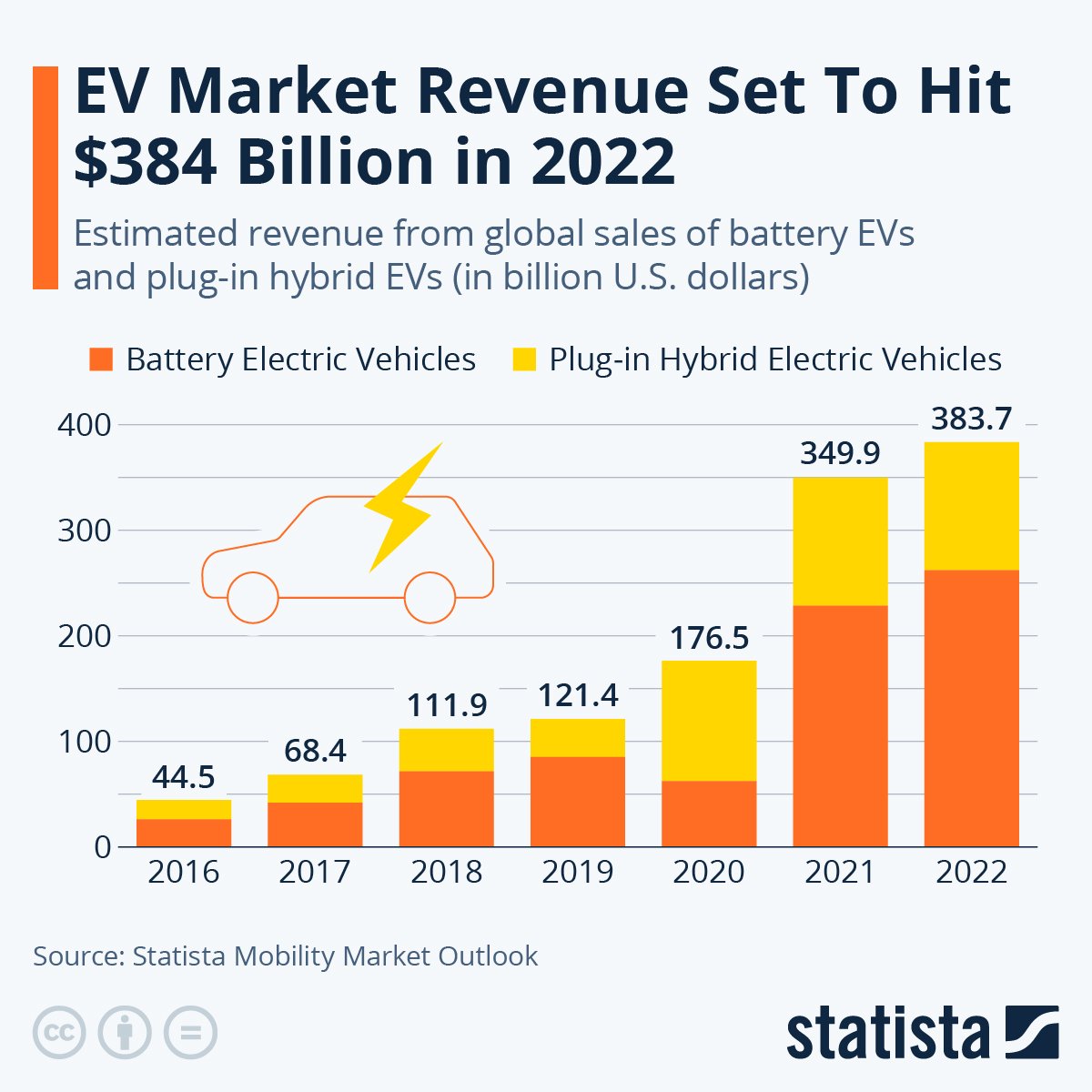

We understand that the electric car industry is growing in popularity and naturally investors want to invest in growing industries, with the added benefit of being socially and ethically responsible or “good for the environment”.

The graph below illustrates the enormous revenue that is starting to be generated from the electric vehicle market.

However, if we focus in on one of the most well-known electric vehicle brands, Tesla, there are four main aspects we need to consider (from a very high level):

Stock Performance

Musk Factor

Bitcoin Exposure

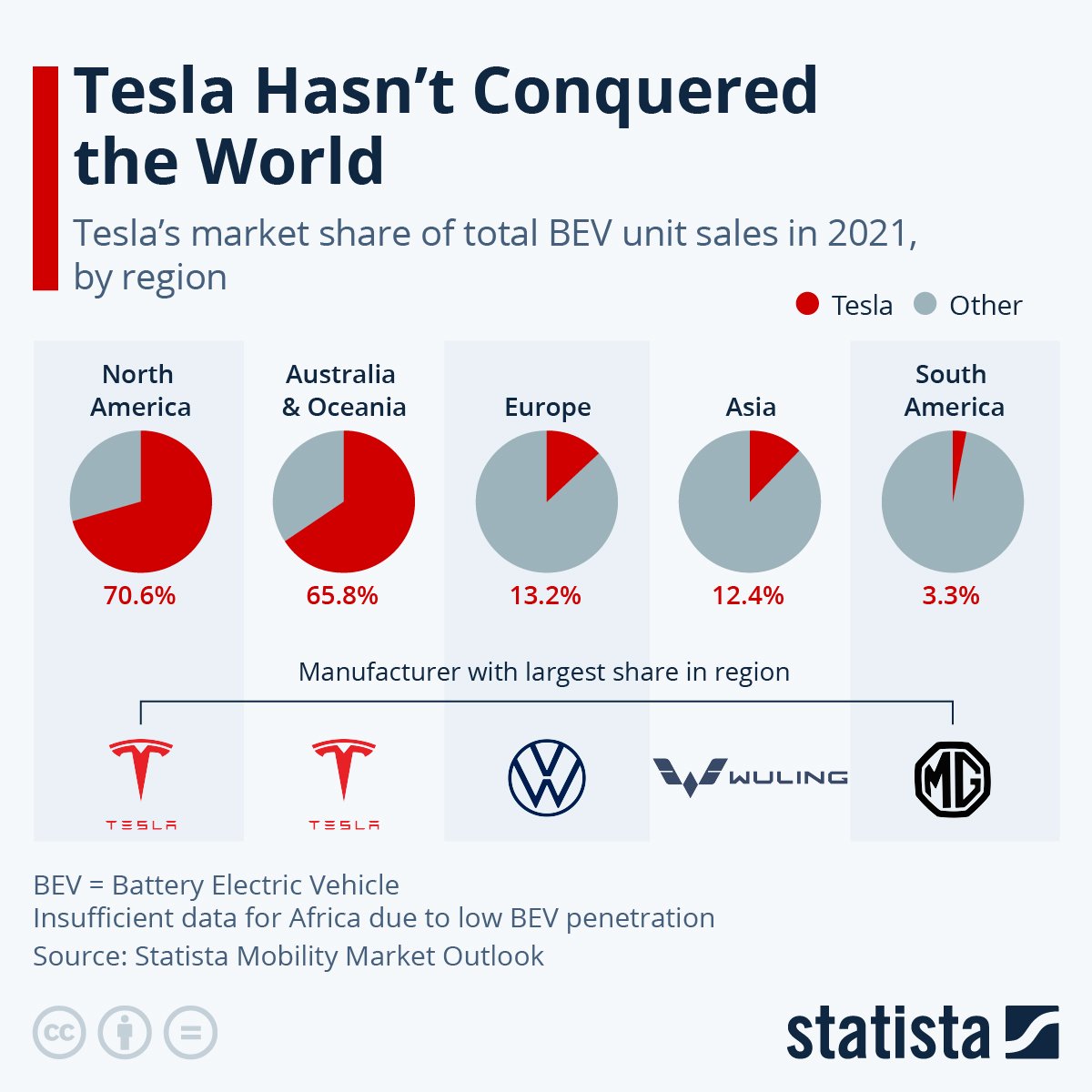

Electric Car numbers

The stock has performed poorly over the past 12 months, down 48%.

Growing competition in electric vehicles, inflation, falling Bitcoin price, softening demand, Covid issues in China which has delayed supplies, soaring material prices and an uncertain economy have all contributed to a fall in Tesla’s valuation.

Tesla recently announced a recall of more than 300,000 cars due to faulty taillights, which has also affected the business in recent months.

Tesla does not just build electric vehicles. Tesla purchased $1.5 billion worth of bitcoin in February 2021. However, a month later Tesla sold off 10% of it’s holding, which boosted profits for the quarter by $272m.

Then in June 2022, Tesla sold 75% ($936m) worth of it’s bitcoin, in order to raise cash for the business operations.

Tesla still holds over $218m worth of “digital assets” (which is mainly Bitcoin), with many experts comparing the price rise and falls of Tesla to that of Bitcoin, as they have followed a similar trajectory in the past.

‘The more I learn, the worse it gets. The world should know the truth of what has been happening at Twitter. Transparency will earn the trust of the people.’

Musk

Tesla’s co-founder & CEO Elon Musk is a visionary and has big plans for the world. To many, Musk has this presence or the illusion that he would not be able to provide his sole focus on Tesla and it’s operations.

This was highlighted in his recent purchase of the social-media network, Twitter, which he acquired last month for $44 billion. Musk has caught headlines across the globe as he made aggressive changes to the platform. Since taking ownership, Musk has also followed through on his crusade to promote free speech, unravel corruption and suppression of stories within politics and elections across the globe, but most impressive of everything Musk has done so far with twitter, is his determination to eradicate child sexual exploitation material from twitter. Over 44,000 accounts have been banned in recent weeks, however Musk recently expressed his grave concerns over the presence of tweets soliciting child sexual exploitation.

And to this point, the more Musk finds out what has been going on at Twitter, the more he continues to make changes and cuts to the workforce. With the company losing 60% of its work force since Musk took over.

Investors have been questioning whether the billionaire is spreading himself too thin among his various high-profile ventures. As it appears he has been preoccupied with his recent Twitter purchase.

Tesla’s dependence on Musk is listed as a risk factor in its security filings, highlighting that “although Mr. Musk spends significant time with Tesla and is highly active in our management, he does not devote his full time and attention to Tesla.”

We have seen over the past 18 months, that a single tweet from Musk can move stock prices or cryptocurrency prices, he has an enormous following that are manipulated with a few tweets.

So despite being one of the most well known global electric vehicle brands, Tesla does not come without risks.

If a client was adamant in investing a small part of their portfolio, into the electric vehicle industry, we would consider a more diversified approach that looks to provide exposure to a portfolio of global companies at the forefront of innovation in automotive technology (not just the manufacturers).