Why should you use superannuation as a retirement savings vehicle?

What is superannuation?

In many countries, including Australia and New Zealand, superannuation (or "super") refers to a type of retirement savings plan. Superannuation is a long-term investment vehicle that is designed to help people save for retirement. It is typically funded through a combination of employer contributions and employee contributions, and can provide a regular income in retirement.

In Australia, the government requires employers to make compulsory contributions to their employees' superannuation accounts, known as the "Superannuation Guarantee". Employees may also make additional contributions to their superannuation accounts, either voluntarily or through salary sacrifice arrangements. Superannuation funds are managed by professional fund managers, and investment returns are typically tax-free.

Overall, superannuation is an important part of the retirement planning process in Australia and New Zealand, and can help people to save for a comfortable retirement.

How much money is in superannuation?

Total superannuation assets were $3.3 trillion at the end of the September 2022 quarter.

How much super do i need for a ‘comfortable retirement’?

According to the Association of Superannuation Funds of Australia Limited (ASFA) for those wanting a ‘comfortable retirement,’ the average super balance at retirement should be around $640,000 for couples and around $545,000 for singles.

These figures presume you own your own home with no mortgage, and cover daily essentials, as well as spend on things like home improvements, dining out, exercise and leisure activities, and occasional holidays, among other things. You may also want to consider what your life during retirement will be like, e.g., will you be in good health, how long might you live, and do you think you’ll need to pay for aged care?

When assessing your desired balance for retirement, a good idea is to think about what you want to spend money on. A ‘modest retirement’ lifestyle for example, is considered better than the Age Pension, but still only enough to be able to afford basic activities.

The average superannuation balance?

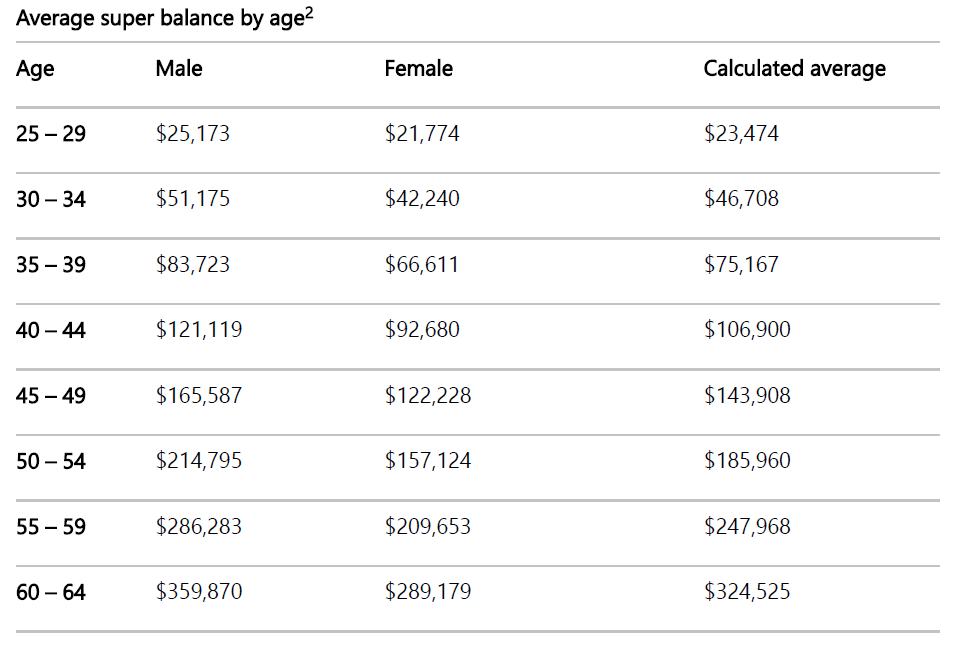

The table below shows the average super balances of Australians across different age groups and genders. We sourced these figures from the Association of Superannuation Funds of Australia (ASFA):

What’s the average super balance by age, and is it enough to track towards a ‘comfortable retirement’?

Research tells us there’s a gap between how much people have in their super now, and how much they need to fund their post-working years.

Why should you use superannuation as a retirement savings vehicle?

There are a number of reasons why people should use superannuation as a retirement savings vehicle. Some of the benefits of using superannuation for retirement savings include:

Tax advantages: Contributions to a superannuation account are generally taxed at a lower rate than other forms of savings, which can help to grow the account faster. In addition, the earnings on investments within a superannuation account are taxed at a lower rate than other forms of income, which can also help to boost savings. And once you reach your preservation age and are retired, your benefits may be tax free. That is tax free on investment earnings, capital gains, and withdrawals.

Compulsory employer contributions: In Australia, employers are required to contribute a certain percentage of an employee's salary to their superannuation account. This can provide an additional source of savings and help to grow the account faster.

Government contributions: The government also provides additional contributions to certain individuals' superannuation accounts, such as the Low Income Superannuation Tax Offset (LISTO) and the government co-contribution. These contributions can help to boost savings and support a comfortable retirement.

Control and flexibility: Superannuation accounts offer a high degree of control and flexibility, allowing individuals to choose their own investments and manage their own savings. This can provide greater freedom to tailor the account to individual goals and circumstances.

Overall, using superannuation as a retirement savings vehicle can provide a number of benefits, including tax advantages, compulsory employer contributions, government support.

Why talk to a Newcastle Financial Planner about superannuation?

It is a good idea to talk to a financial planner about superannuation for a number of reasons. Some of the benefits of speaking with a financial planner about superannuation include:

Expertise and guidance: Financial planners are trained to help clients understand and manage their superannuation accounts. They can provide guidance on how to maximize the benefits of superannuation, such as by taking advantage of tax advantages and government contributions.

Customized advice: A financial planner can provide personalized advice that is tailored to a client's individual circumstances and goals. This can include taking into account a client's retirement goals, risk tolerance, and other factors to develop a strategy that is designed to maximize the benefits of superannuation.

Ongoing support: A financial planner can also provide ongoing support and guidance to help clients manage their superannuation accounts and adapt to changing circumstances. This can help to ensure that a client's superannuation account is positioned to provide the greatest benefits over the long term.

Overall, speaking with a financial planner about superannuation can provide valuable expertise and guidance to help clients maximize the benefits of their superannuation accounts.

Meet The Author

Matthew McCabe

Matthew McCabe is an expert financial planner who has been in the financial services industry for over 18 years. He specialises in supporting everyday Australians retire on their terms by making the complex seem simple.

Matthew is the founder of Newcastle Advisors, an organisation that is dedicated to empowering individuals through financial literacy and education, to ensure Australians have the tools and information to make an informed decision about their financial future.

Matthew has also been a finance expert contributor to the Newcastle Herald, Channel 7 News, Canberra Times, Starts at 60 and Hunter Headline.