Setting Goals For 2024

Start making your goals today and see where they take you tomorrow.

Our financial planners discuss how to set goals, why goals are important, why setting goals can be difficult and how a financial planner can support you in setting your goals and putting a plan in place to achieve your goals

Read More

Top Financial Goals For 2024

What are the top financial goals for 2024?

Recent research from CBA has revealed the top financial goals for 2024. Our Newcastle Financial Planning Advisers discuss five practical tips to support you and where you can go for expert financial advice.

Read More

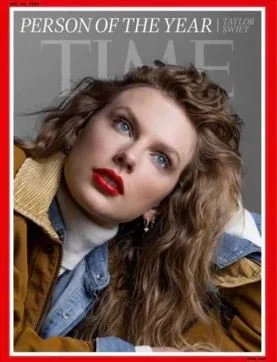

2023: The Year We Shook It Off

As we wave goodbye to 2023, it's time to reflect on a year that's seen optimism return to investment markets around the globe.

With the official end of the COVID-19 pandemic and as the risk of a recession subsides, global markets have exceeded expectations in 2023, suggesting we may be Out of the Woods. This upturn is thanks in large part to the mega-cap technology stocks known as the Magnificent Seven, which have woven a Love Story with the markets. As we observe would might be the End Game of economic uncertainty, investor sentiment has shifted from “a recession is coming” to “a soft landing is around the corner”, a situation where everyone needs to be Ready for It.

Read More

Financial Abuse

Financial abuse of the elderly, a troubling yet often unspoken issue, is becoming an increasingly prevalent trend. We see cases where adult children, typically in their 40s, 50s, or 60s, subtly or overtly exert influence over their aging parents' financial decisions.

Read More

Financial Advice for Doctors in Newcastle

Many healthcare professionals fail to achieve this balance, not due to a lack of funds, but because of an absence of a strategic financial plan.

Recognising this, Newcastle Advisors offers bespoke financial strategies tailored to medical professionals, designed to enhance your financial health with minimal time commitment from your end, allowing you to focus on your patients while we handle your financial wellbeing.

Read More

Navigating the Financial Landscape After Loss: Expert Guidance from Newcastle Advisors to Ease the Burden of Bereavement

Navigating the Financial Landscape After Loss:

Expert Guidance from Newcastle Advisors to Ease the Burden of Bereavement.

The loss of a partner or loved one is one of the most challenging experiences that anyone can face, marked by profound grief and emotional distress. When faced with such a loss, especially if your partner was the chief financial officer of your household, managing practical matters like finances can seem daunting.

Read More

Managing the Financial Impacts of Redundancy

Financial advice is relevant to almost everyone at many significant stages of life. And that includes the uncertainty after being made redundant.

Financial Advice isn’t necessarily about how much money you have today. It’s about protecting your family & ensuring your financial security.

Everyone has a situation that is unique to them. It could be how to get rid of debt, how to use debt, how to retire early or how to deal with the current uncertainty. At Newcastle Advisors we have an innate ability to solve problems.

Read More

Is this the rate rise that stops a nation?

The rate rise that stops a nation?

The first Tuesday in November is normally remembered for the Melbourne Cup, the race that stops the nation. However, many are saying that the first Tuesday in November in 2023 may be remembered for the rate rise that stops a nation.

Read More

PPS Mutual Accredited Adviser

Our Newcastle Advisors principal financial planner, Matthew McCabe has been accredited to provide advice with PPS Mutual. Matthew becomes only the second accredited financial planner in the Newcastle region.

Now our team is able to offer more support to doctors, dentists, accountants, solicitors, barristers, judges, and allied health professionals.

Read More

Are you considering selling your investment property?

Are You Considering Selling Your Investment Property?

Do you find yourself getting anxious over your tight cash flow? Are you lying awake at night, stressed about your mortgage payments? If you're facing these financial pressures and pre-empting another interest rate rise with dread, you’re not alone.

It used to be that buying an investment property was a sure bet, a great way to earn extra money. But now, as interest rates climb, people have found themselves trying to get a grip on their personal finances, leading many to deal with the possibility of selling their investment properties – a thought that once seemed distant.

Read More

Unlock Your Wealth: The Power of Financial Planning for Small Business Owners

Unlock Your Wealth: The Power of Financial Planning for Small Business Owners

Running a small business is no small feat. It's a complex, multi-faceted endeavour where you wear many hats—entrepreneur, technician, manager, and director, often all at once. You're dedicated to the growth and success of your business, but in doing so, are you inadvertently locking up your wealth within your company? Or even your commercial property your business operates out of?

It's a common scenario. Many small business owners tend to reinvest their profits back into their businesses, or their premises, a prudent strategy for growth. However, this could pose a risk if a sudden downturn, disruptive competition, legal troubles, or unforeseen market shifts occur. Your personal and financial well-being might be at stake.

Read More

October 2023 Market Update

October Market Update

In October 2023, the financial landscape globally was marked by several pivotal movements, some arising out of decisions made by central banks, some influenced by global and domestic economic indicators, and others resulting from geopolitical situations. For our clients and prospects who are seeking clarity amidst the headlines, here's a concise wrap-up of recent events and our perspective on the path ahead.

Read More

When you’re studying or starting out, every dollar counts. Make the most of your money, so you can get on with your life.

When you’re studying or starting out, every dollar counts.

Make the most of your money, so you can get on with your life.

When you're a young adult juggling study and work, every dollar counts. As you embark on this exciting journey, mastering personal finance is vital to ensure you can make the most of your money and build a secure financial future. It might sound daunting, but with a little discipline and the right guidance, you can take control of your finances effectively and efficiently. Developing good financial habits from a young age is your ticket to a comfortable and prosperous life

Read More

Mastering the Art of Tax-Efficient Investing: The Power of Education Bonds

Mastering the Art of Tax-Efficient Investing: The Power of Education Bonds

In a world where financial planning is becoming increasingly critical, Australians are seeking answers to navigate the complex tax landscape. With both state and federal governments eyeing ways to boost their revenue, it's crucial to explore tax-efficient investment options.

Many individuals, particularly the self-employed or those in the highest tax bracket, are concerned about the prospect of paying a staggering 47 percent in taxes while taking additional financial risks to secure their family's future. Additionally, the proposed Division 296 tax on superannuation balances exceeding $3 million is prompting more Australians to rethink their financial strategies.

Read More

Unlocking the Future of Your Superannuation: New Taxes and How They Affect You

Unlocking the Future of Your Superannuation: New Taxes and How They Affect You

In the ever-evolving world of finance, change is a constant. And the Australian government is no stranger to tweaking the rules, especially when it comes to your superannuation. We, at Newcastle Advisors, believe in keeping you well-informed about the latest developments that could impact your financial future. Today, we're diving into the intricacies of Division 296 Tax, a new tax proposal that could change the way you plan for your retirement.

Read More

Navigating the Tax Maze: What You Need to Know About TPD Claim Payouts

Navigating the Tax Maze: What You Need to Know About TPD Claim Payouts

When it comes to your financial future, knowledge is power.

At Newcastle Advisors, we believe in empowering you with information that matters. It's not just about planning for retirement; it's about understanding every facet of your financial journey. We shed light on a lesser-known aspect of financial planning: the taxation of TPD (Total and Permanent Disability) claim payouts. It's time to demystify the tax implications and equip you with the insights you need.

Read More

Unlocking Hidden Savings: Navigating Australia's Death Benefits Tax with Newcastle Advisors

We all know the two certainties in life: death and taxes.

But did you know that Australia has its own unique twist on this old adage?

It's called the "Death Benefits Tax," and it's a financial curveball that's often missed in many financial plans.

At Newcastle Advisors, we understand the intricate dance of taxes and financial planning. We're here to help you make informed decisions, maximize your wealth transfer, and ensure that your hard-earned assets benefit your loved ones as much as possible. Don't let Death Benefits Tax catch you off guard; let's plan your financial future together. Contact us today for a personalised consultation and unlock hidden savings you never knew existed. Your legacy deserves nothing less.

Read More

Victorian woman who claimed mammoth $60M Powerball prize reveals plan to help favourite causes with new fortune

As financial advisers, the statement by the $60m Powerball winner grabbed our attention.

The sole winner wishes to hep her favourite causes by donating a significant chunk of the money to charities that support children.

However there are a myriad of ways to ‘give’. You can donate to charities on an ad-hoc basis, you can sign up for regular payments to a major Non-Governmental Organisation, or you can get strategic and take a considered approach to how your structure your donation, enabling it to grow into perpetuity.

Read More

Planning for Retirement: Navigating the Australian Dream

Planning for Retirement: Navigating the Australian Dream

Retirement: a phase of life that many Australians look forward to with anticipation, where dreams of relaxation, adventure, and financial security often take centre stage. It's a time when work becomes optional, and leisure, travel, and cherished pursuits come into focus, while financial worries gradually fade into the background. At the heart of this vision is superannuation, the Australian government's retirement savings scheme, playing a pivotal role in turning this dream into reality. Newcastle Advisors, the trusted financial planning advisory firm in Warners Bay, NSW, understands the complexities of retirement planning and aims to guide you through this journey.

Read More

Bridging the Expectation-Reality Gap: Navigating Retirement Savings with Newcastle Advisors

Bridging the Expectation-Reality Gap: Navigating Retirement Savings with Newcastle Advisors

Retirement is a journey, one that begins with dreams of relaxation, adventure, and financial security. Australians, like many around the world, often embark on this voyage with high hopes of a comfortable and worry-free retirement. However, the path from these lofty expectations to the often more sobering reality can be a winding one. It's a journey marked by challenges, choices, and the pivotal role of superannuation—a journey where Newcastle Advisors, a trusted financial planning advisory firm in Newcastle, stands as a beacon of guidance.

Read More