Podcast Recommendation

Our latest podcast recommendation is Aswath Damodaran - Making Sense of the Market - on - Invest Like the Best with Patrick O'Shaughnessy

Aswath provides a fascinating insight into everything from inflation, what we can learn from past inflationary times, The Fed Reserves role in managing inflation, how smart companies are adjusting to inflation, thoughts on Facebook, Apple and Microsoft.

Who is Aswath Damodaran?

Aswath Damodaran, is a Professor of Finance at NYU’s Stern School of Business.

Aswath is one of the clearest teachers of investing and finance in our industry and through his blog, books, and YouTube has open-sourced his wisdom for decades. This podcast is a masterclass of key investing concepts. They discuss inflation, narratives, disruption, the evolution of alpha and edge..

Aswath has been called Wall Street's "Dean of Valuation", and is widely respected as one of the foremost experts on corporate valuation.

The thing we love about Aswath and his views is that he is not trying to sell us anything.

Generally when you have an “investment expert” whether it is in real estate, stocks, cryptocurrency or anything in between, they are trying to sell you a book, a product, a course or their service. However, this is not the case with Aswath.

Aswath Damodaran

Key insights

Inflation is the genie in the bottle.

When it is in the bottle, you can look at it, laugh at it and talk about it.

However, as soon as the genie is out of the bottle, it is difficult to get back in.

The higher inflation number implies that the US economy is running too hot and may have to be slowed with faster and larger rate rises than previously expected, which then raises the risk of a recession if the economy cools too fast.

We have seen a number of different views in the market. With people who have never lived through an inflationary period saying “What’s the big deal”.

The big deal is that inflation takes over the conversation, it drives everything else. It drives the market.

People’s expectations are set by what they have lived through. Most investors in the market have only entered into the market in the past 10, 15 or 20 years. For these investors the only inflation they have known is low and stable inflation.

This is the behavioural component for people to adjust their expectations.

To breakdown inflation we need to separate into two parts

Expected Inflation

Expected inflation Is something we can build into our financial assets. Furthermore, expected inflation is the benign part of inflation.

Unexpected Inflation

Unexpected inflation is the deadly part.

Inflation coming in higher or lower than expected is the main concern for markets around the world.

When inflation is unexpected you have not had a chance to adjust to it and financial assets have not had an opportunity to reprice assets.

Markets have been trying to adjust and understand what the true inflation is going to be. Currently inflation sits at just over 8% and is probably too high, with some of it being supply chain issues and covid excuses that were given early on.

We are not going back to 1-1.5% inflation that we have experienced for the past decade. The question is where do we fall between the 1.5% and the 8% is what is driving markets.

Other insights

Aswath would never invest in the “best performing” investment/ company.

As are we rewarding investment managers and companies for taking the most risk?

Aswath prefers someone who has been consistent over a prolonged period of time, that doesn’t

If you are getting a product or service for free you are the product. e.g. facebook, google maps, robinhood

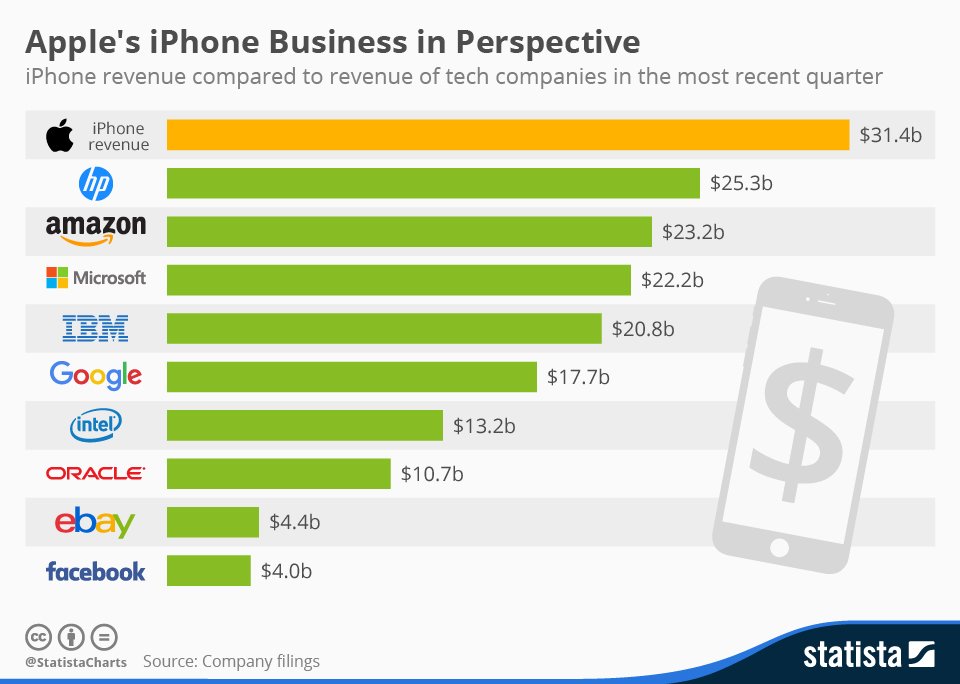

The iPhone is the single most lucrative product in history. The cashflow it has generated for Apple is gigantic.

Apple generated $365 billion revenue from the iPhone which represented 52% of the total revenue.

Apple is a $3.5 trillion company built on a single product. They are now a mature business that is banking on people upgrading their phones. From an investors point of view, this is a huge risk with over 50% of revenue and profits coming from one particular product.

Date from 2015

We found you really have to be in the right headspace to get through the two hour interview, however the amount of knowledge and information that is provided is phenomenal.

Let us know your thoughts - or if you have another investing/finance podcast that you recommend.

https://podcasts.apple.com/us/podcast/aswath-damodaran-making-sense-of-the-market/id1154105909?i=1000564650213