Global Markets Overview: What This Means for Your Financial Plan

Global Markets Overview: What This Means for Your Financial Plan

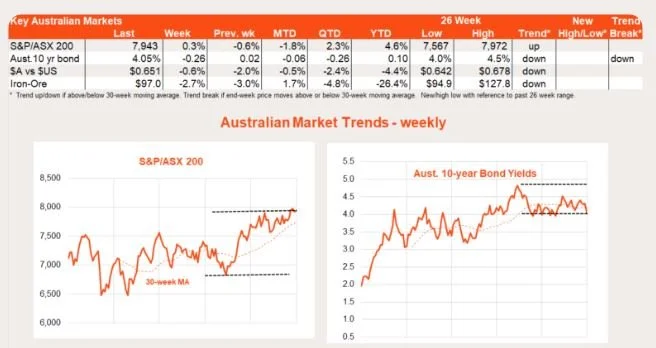

Last week, global markets experienced a noticeable shift, with weak U.S. economic data leading to a pullback in equities and a rally in bonds. This change signals that "bad news is bad news again" in financial markets, marking a return to traditional market reactions after a period where bad news sometimes had positive effects on stocks due to expectations of supportive monetary policy.

Initially, there was some optimism as the U.S. Federal Reserve hinted at a potential rate cut next month, citing declining inflation. However, this optimism was dampened by weaker-than-expected reports on U.S. manufacturing and employment. The U.S. manufacturing index fell more than expected, suggesting that high interest rates and a strong U.S. dollar are beginning to impact the economy.

Key Takeaways

Recent shifts in global markets have been driven by weak U.S. economic data

Equities have pulled back while bonds have rallied, signalling a return to traditional market reactions

The Federal Reserve's role in supporting the economy will be crucial in the coming months

Manufacturing and employment indicators have been impacted by the strong U.S. dollar and high interest rates

Reviewing your investment portfolio, staying informed, and maintaining a long-term focus are key to navigating market volatility

Implications for Your Financial Situation

As a client of Newcastle Advisors, understanding how these global market movements might impact your financial situation is crucial. The current market environment, characterised by slowing economic growth and fluctuating interest rates, could affect your investments, particularly if you're heavily invested in equities, especially in growth and technology sectors. Additionally, global economic uncertainties may lead to increased market volatility, which can impact the value of your portfolio over the short-term.

What Should You Do Next?

Given these developments, it may be an opportune time to review your financial plan and investment strategy. Here are a few steps to consider:

1. Review Your Portfolio: Consider whether your current asset allocation aligns with your risk tolerance, especially in light of potential market volatility. It might be worth discussing with your financial planner whether to rebalance your portfolio or adjust your exposure to certain sectors.

2. Stay Informed: Newcastle Advisors are keeping up to date with the economic reports and central bank decisions, as these can significantly impact markets. Understanding these trends can help you make more informed decisions. However, your Newcastle financial planner will be in contact should changes to be made.

3. Long-Term Focus: While short-term market movements can be unsettling, it's important to maintain a long-term perspective. Your financial plan is designed to withstand market fluctuations, and making long term decisions based on short-term trends could lead to missed opportunities.

4. Schedule a Review: If you have concerns about how these global developments might impact your financial goals, consider scheduling a meeting with your financial planner at Newcastle Advisors. We can provide personalised advice based on your unique situation and help you navigate these uncertain times.

By staying proactive and informed, you can better position yourself to weather market fluctuations and stay on track to achieve your financial goals.