Expert Retirement Planning Advice for Australians

Expert Retirement Planning Advice for Australians

We all dream of a comfy retirement without money worries. But, it takes careful planning and smart choices. This guide offers top tips for Aussies. We'll cover how to make the most of your super and understand aged care.

Before we start, think about this:

Are you ready for retirement's financial challenges?

Getting this right can change everything. Let's look at how to make sure you're set for a good retirement.

Key Takeaways

Comprehensive retirement planning advice tailored for Australians

Optimising your superannuation and investment strategies

Navigating the aged care system and estate planning

Securing your financial future and achieving the retirement you deserve

Addressing the pressing question of financial preparedness for retirement

Retirement Planning Advice: A Comprehensive Guide

Starting early is key to good retirement planning. It helps you be financially secure and enjoy your retirement. By planning ahead, you can make sure you have enough money for the future.

Understanding the Importance of Early Planning

Retirement planning is a long-term process. It needs careful thought and planning. By starting early, you can grow your savings and investments over time.

Planning early lets you make smart choices. You can adjust your savings and investments as needed. This can greatly improve your retirement lifestyle.

Assessing Your Retirement Needs and Goals

Everyone's retirement plan is different. It depends on your life, money goals, and what you want for the future. By looking at what you need and want, you can make a plan that fits you.

Think about when you want to retire, how much money you'll need, your health care needs, and if you want to leave money for others. Knowing these things helps you pick the right retirement planning advice and investments.

"The key to a successful retirement is planning ahead and making informed decisions.

By starting early and aligning your strategy with your unique goals, you can build a secure and fulfilling retirement."

- Retirement Specialist Advisor - Matthew McCabe from Newcastle Advisors

Superannuation Strategies for a Secure Retirement

Superannuation is key to planning for retirement in Australia. It's vital to find ways to boost our superannuation and investments. By doing so, our retirement savings can grow steadily, giving us financial security.

One good strategy is to focus on superannuation strategies that help with tax-effective investing. This could mean salary sacrificing some of our income into super or using government co-contributions to increase our savings.

We should also think about diversifying our investment portfolios in superannuation. This means having a mix of assets that grow and those that are more stable. Options could include shares and fixed-interest investments.

Using these superannuation strategies and focusing on tax-effective investing helps us build a strong investment portfolio. This will support us in our retirement. With good planning and commitment, we can look forward to a secure future.

Building an Investment Portfolio for Retirement

Building a diverse investment portfolio can add extra income and growth for your retirement, along with your superannuation. We'll look at how to spread your investments and manage risks to get the best returns on your investments.

Diversifying Your Investments

Diversifying your investment portfolio is crucial. Spread your money across different types like stocks, bonds, real estate, and more. This reduces risk and can lead to better growth over time. It keeps your wealth management safe from the ups and downs of any one investment.

Put your money in various assets, sectors and industries to lessen the impact of market changes.

Include both local and international investments to take advantage of global trends.

Have a mix of assets that grow in value and those that provide income and are more defensive to balance risk and reward.

Managing Risk and Returns

Managing your investment portfolio well means finding the right balance between risk and return for your financial independence goals. Know your risk level and how long you can wait for your investments to grow. This helps you pick the right mix of assets that could give you the best returns while keeping risks low.

Think about how much risk you can handle and adjust your portfolio based on your age, goals, and time frame.

Check your portfolio often and rebalance it when needed to keep it in line with your risk and return goals.

Look into strategies like dollar-cost averaging and diversification to reduce the effects of market ups and downs (which is exactly what your regular superannuation contributions is achieving).

Creating a great investment portfolio for retirement means looking at everything together. It's about spreading your investments, managing risks, and thinking long-term. With the help of financial experts, you can make a wealth management plan that helps you reach financial independence.

Pension Planning: Navigating the Australian System

Planning for retirement in Australia means understanding the pension system well. Knowing about the Age Pension is key to a good retirement plan. We'll look at the Age Pension's details, like who can get it, how much they get, and how it fits into retirement planning.

Understanding the Age Pension

The Age Pension is a program that helps eligible Australians in retirement. You need to meet certain criteria like age, residency, and income to get it. Learning about the Age Pension helps us plan better for the future and get the most out of it.

Age Pension Eligibility Criteria

Age Requirement - currently 67 years of age

Australian residency for at least 10 years

Asset Test

Couple Homeowner

has less than $314,000 in assessable assets to receive the full pension

has less than $686,250 in assessable assets to receive part pension

Single Homeowner

has less than $470,000 in assessable assets to receive the full pension

has less than $1,031,000 in assessable assets to receive the part pension

Income Test

Couple

Up to $372 per fortnight in assessable income to receive the full pension

Over $327 per fortnight in assessable income, each member of the couple will have your pension reduced your pension by $0.25 for each dollar over the threshold.

Single

Up to $212 per fortnight in assessable income to receive the full pension

Over $212 per fortnight in assessable income, your pension will reduce by $0.50 for each dollar over the threshold.

Rates are adjusted twice yearly to keep pace with the cost of living.

Understanding the Age Pension and adding it to your pension planning can make retirement more secure. It helps with your income streams and aged care solutions too.

"Navigating the Age Pension system can be complex, but with the right guidance,

you can maximise your retirement income and achieve financial security."

- Matthew McCabe - Retirement Financial Planner - Newcastle Advisors

Aged Care Solutions: Preparing for the Future

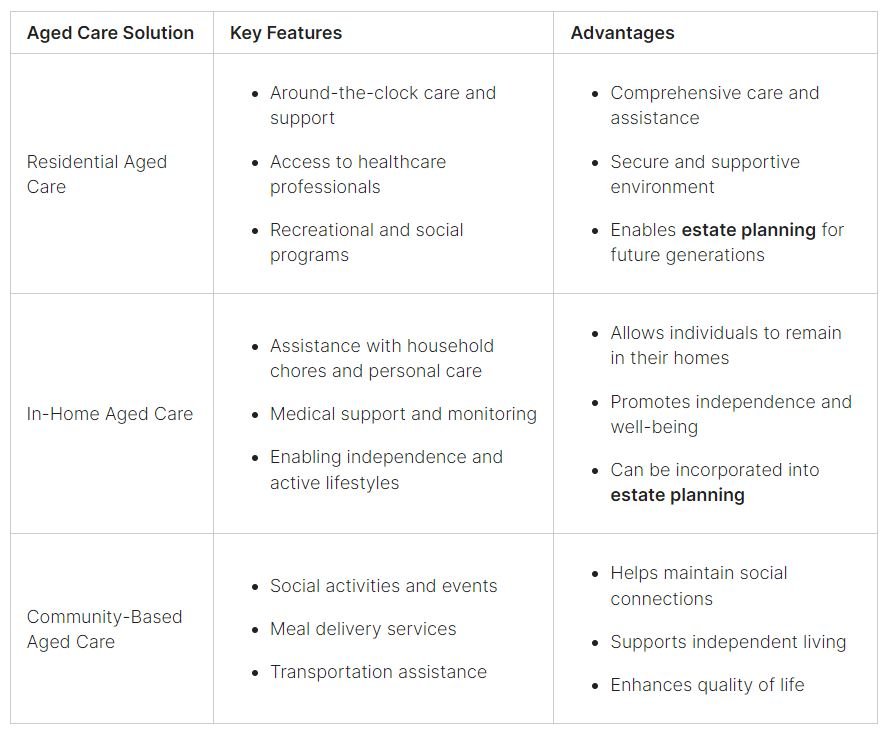

As we age, the need for reliable aged care grows. In Australia, we have many options for retirees. These range from living in care facilities to getting help at home and joining community programs. Each option is designed to fit what each person needs.

Planning for retirement means thinking about aged care costs. Knowing what these costs are helps us manage our money better. This is part of looking after our wealth.

Residential aged care offers full-time care for those needing a lot of help. It provides a safe place with healthcare and activities. Planning our estates can make moving to this care easier and protect our wealth for the future.

In-home care lets us stay in our own homes longer. It includes help with cleaning, personal care, and health support. Adding these services to our estate plans helps protect our wealth and respects our wishes.

Community-based care is also important as we age. It includes things like social events, food delivery, and help with getting around. These services keep us connected and improve our quality of life.

Looking at all the aged care options in Australia and planning for retirement gives us peace of mind. We can look forward to a fulfilling retirement, knowing we're prepared for the future.

Looking at the different aged care options in Australia and planning for retirement gives us confidence. We can look forward to a fulfilling and secure retirement.

Estate Planning: Protecting Your Legacy

Planning for retirement is more than just about your financial future. It's also about protecting your legacy.

We'll look at the key parts of estate planning, like making wills and trusts. We'll also cover how to reduce inheritance taxes and make sure your assets go where you want them to.

Wills and Trusts

A well-made will is the core of your estate plan. It tells everyone how you want your assets shared out, making sure your loved ones are looked after. Trusts add another level of safety, letting you keep control of your wealth and cut down on inheritance taxes.

Minimising Inheritance Taxes

Inheritance taxes can really eat into the value of what you leave behind. With help from financial and legal experts, you can find ways to lessen the tax load on your heirs. This includes smart asset planning, giving gifts, and trusts. Good estate planning keeps your wealth safe and makes sure your legacy is passed on right.

"Estate planning is not just about the distribution of your assets – it's about protecting your family's financial future and leaving a lasting impact." - Matthew McCabe, Newcastle Advisors

Adding estate planning, wealth management, and financial independence to your retirement plan is key to protecting your legacy. By making a detailed plan, you can make sure your wishes are followed and your family is taken care of, long after you're gone.

Creating Income Streams for Retirement

Retirement is a time to enjoy the fruits of your hard work. It's important to have a steady income. We'll look at ways to make sure you have enough money, like annuities and drawdown strategies, to add to your super and pension.

Annuities: Securing a Steady Income

Annuities are a great way to get a steady income in retirement. You put in a lump sum and get regular payments for life. This means you always have money coming in, giving you peace of mind and helping you avoid running out of savings.

Drawdown Strategies: Balancing Flexibility and Longevity

With drawdown strategies, like account-based pensions, you can use your super in a flexible way. You can take out money when you need it, making sure you have enough for the future. This is good for retirees who like to keep control over their money and be adaptable.

Think about what you want from retirement, how much risk you can handle, and what you need for income. Mixing different income streams can help you have a secure and comfortable retirement. Talking to a financial advisor can help you make the best plan for your situation.

Tax-Effective Investing for Retirees

As you move into retirement, it's vital to make the most of your investments. There are special strategies that can boost your retirement income and help you gain financial independence.

Retirees need to think about how different investments affect their taxes. Tax-effective investing means arranging your portfolio to cut your taxes. This way, you keep more of what you've saved.

We'll show you how to use superannuation and other investments like annuities and trusts. These strategies can improve your wealth management and make retirement more comfortable.

Superannuation and Tax-Effective Investing

Superannuation is a great tool for retirees looking to save on taxes. By putting more into your super and using tax breaks, you could increase your savings and pay less tax.

Look into salary sacrificing into your super fund

Learn how super withdrawals are tax-free in retirement

Use the low tax rate on earnings in your super account

Exploring Alternative Investment Structures

There are other investment options that can save you on taxes, such as:

Annuities: These offer a steady income that's taxed less.

Trusts: Some trusts can lower your taxes and protect your money.

Managed Funds: Certain funds are made to be tax-efficient for retirees.

Investment & Education Bonds: can lower your taxes and have estate planning benefits

By spreading out your investments and using these tax-smart options, you can boost your wealth management. This ensures a better retirement.

By using these tax-effective strategies, retirees can increase their financial independence. This leads to a more secure and enjoyable retirement.

"Effective tax planning is the key to unlocking your true retirement potential."

- Matthew McCabe - Retirement Specialist Advisor - Newcastle Advisors

Wealth Management: Maximising Your Retirement Funds

Managing your wealth well is key to a comfy and secure retirement. Working with skilled financial experts can help Australian retirees make the most of their retirement savings. We'll look at how financial advisors can boost your wealth management plan.

Working with Financial Professionals

Retirement planning and wealth management can seem complex. But, financial professionals offer great advice and know-how. With a financial planner or advisor, you can craft a plan to maximise your retirement funds and achieve financial independence. They can assist you:

Check your finances and set clear retirement goals

Build an investment portfolio that fits your risk level and goals

Use tax-smart strategies to cut your taxes in retirement

Look into other ways to earn money, like annuities or drawdown plans

Keep checking and tweaking your retirement planning advice as things change

With the help of financial experts, you can make sure your retirement savings work hard for you. This means you can live the life you want and have financial security for the long term.

By working with financial experts, Australian retirees can be sure their wealth management plans are set up for long-term financial security and financial independence.

Achieving Financial Independence in Retirement

Retirement planning is more than just saving money. It's about becoming financially independent. This means we can live our golden years with confidence and freedom. By using the right strategies and mindset, we can make our retirement fulfilling and self-sufficient.

Financial independence in retirement comes from having different income sources. These can include superannuation, investments, pensions, and passive income. This mix helps us live our desired lifestyle without needing a job.

To get financially independent, we need to plan and manage our money well. We should also make smart tax-effective investments and work with financial experts. By being proactive and disciplined in planning, our wealth will support us, not the other way around.

Financial independence in retirement is not just about money. It's also about feeling confident and self-reliant. It means making smart choices, adapting to changes, and enjoying life on our terms.

On our journey to financial independence, we must balance our short-term needs with our long-term dreams. By staying focused, flexible, and open to advice, we can make a retirement plan that empowers us. This plan lets us live the life we've always wanted.

"Retirement is not the end of the road. It is the beginning of the open highway." - Matthew McCabe - Senior Financial Planner - Newcastle Advisors

Retirement Planning Advice: Tailored Solutions

Retirement planning isn't a one-size-fits-all job. Every Australian has different needs, goals, and situations. That's why getting advice that fits your life is key.

Considering Your Unique Circumstances

At Newcastle Advisors, we know your age, lifestyle, health, and family can change how you plan for retirement. We take these into account to make a plan just for you.

Age and life stage: Your planning changes if you're starting to save or getting close to retirement.

Lifestyle preferences: We make sure your plan fits your dream life, whether it's traveling or staying home.

Health considerations: Your health now and in the future affects your financial planning, including healthcare costs.

Family dynamics: We consider your family's needs to make sure your retirement plan covers everyone.

We use these details to give you retirement planning advice that matches your financial and personal goals.

"Retirement planning is not a one-size-fits-all solution.

It's about creating a personalised roadmap that empowers you to live your best life in your golden years."

- Matthew McCabe - Retirement Planning Specialist - Newcastle Advisors

Our local financial advisors are here to help, whether you're just starting or already enjoying retirement. We offer superannuation strategies and investment portfolios to help you be financially independent and secure.

We make sure your retirement plan is as unique as you are. This way, you can look forward to a fulfilling and worry-free retirement.

Retirement Planning Mistakes to Avoid

Planning for retirement can be tricky and complex. It's easy to make mistakes that can slow you down. As you plan for your retirement, watch out for common errors that could affect your financial goals. We'll look at the mistakes to avoid to help you stay on track.

One big mistake is not saving enough in your superannuation fund. Many Australians don't put enough money aside for retirement. It's key to know how to make the most of your superannuation to build a bigger retirement fund.

Another common error we see is not spreading your investments out (diversifying). Putting all your money in one place can be risky. By spreading your investments across different areas like stocks, fixed interest, and property, you can reduce risk and aim for a steady retirement income.

Not planning for unexpected costs like healthcare or aged care can be a big problem. It's important to think about these costs now to avoid financial trouble later.

Not keeping your estate planning documents up to date can cause issues for your family. It's vital to regularly check and update your wills and trusts to protect your loved ones.

By avoiding these common mistakes, you can make sure your retirement is secure and worry-free. Remember, the secret to good retirement planning is to start early, get expert advice, and keep adjusting your plans as things change.

"The best time to plant a tree was 20 years ago. The second best time is now." - Chinese Proverb

Staying on Track: Reviewing Your Retirement Plan

Retirement planning is a continuous process that needs regular checks and tweaks. As our lives and financial situations change, it's key to review and adjust our retirement plans. This ensures we're moving towards financial freedom.

It's vital to regularly check your retirement plan. This helps you see if your goals are still right, spot any changes in your life or finances, and adjust your plan as needed.

Check your retirement savings and investments often, making sure they're spread out and doing well.

Look at your retirement income, like your superannuation and other investments, to make sure they meet your needs.

Think about how life changes might affect your retirement plans, such as new jobs, health issues, or family duties.

Getting advice from retirement experts can be really helpful when reviewing your retirement plan. They offer valuable advice to help you deal with the complex world of retirement planning advice. This ensures your plan fits your unique situation.

Whilst consulting your financial planner at least annually, to ensure that your strategy and underlying investments are still reflective of your personal and financial situation.

Remember, financial independence in retirement is a journey, not a finish line. By keeping an eye on your retirement plan and making regular changes, you can handle the ups and downs. This way, you can make sure your retirement is secure.

Retirement Planning Advice from Newcastle Advisors

At Newcastle Advisors, we help Australians reach their retirement dreams. Our team of skilled financial experts offer retirement planning advice tailored just for you.

We work with our clients to create detailed plans that meet their specific needs and dreams, ensuring a secure and happy retirement.

Our Newcastle Advisors method focuses on knowing each client's unique situation, finances, and future goals. We listen, analyse, and design custom plans.

These plans use the most appropriate investment and income strategies.

Comprehensive financial planning to align your retirement goals

Tailored superannuation and investment strategies

Maximising government benefits and age pension eligibility

Efficient estate planning and wealth transfer solutions

Ongoing support and portfolio monitoring for your peace of mind

We are known for our dedication and focus on our clients, making us a top retirement planning firm in Australia. We serve individuals and families in Newcastle and nearby, helping them get the retirement they want.

"Newcastle Advisors has been instrumental in helping me plan for a comfortable and secure retirement.

Their expertise and attention to detail have been invaluable."

- David, 65, Newcastle

If you need retirement planning advice from a reliable and skilled team, get in touch with Newcastle Advisors. Let us help you plan a fulfilling and financially secure retirement.

This guide has covered the key parts of retirement planning for Australians. We've shown why early planning is crucial and how to deal with superannuation, investments, and aged care. We've given you lots of expert advice to secure your financial future.

We've talked about building a varied investment portfolio, managing risks and returns, and creating steady income. This helps you take charge of your retirement planning and aim for financial freedom. We've also looked into the Australian pension system, estate planning, and tax-smart investing. This gives you the info to make smart choices and safeguard your legacy.

Starting your retirement journey means always checking and changing your plan to keep it working well. Keep an eye on things and work with financial experts. This way, you can handle the changes in retirement planning and enjoy the retirement you've worked for.

FAQ

What are the key considerations for early retirement planning?

Early retirement planning is key for a secure future. Start by checking your retirement needs and goals. Then, boost your superannuation, diversify your investments, and learn about the Australian pension system.

How can I optimise my superannuation strategy?

To boost your super, increase your contributions and pick tax-effective investments and structures. Also, keep an eye on your super fund to make sure it meets your retirement goals.

What are the key principles of building an investment portfolio for retirement?

For retirement savings, focus on spreading your investments, managing risks, and aiming for good returns. Use a mix of assets like shares, fixed interest, and property for steady income and growth.

How can I navigate the Australian pension system?

Get to know the Age Pension, its rules, and how much you might get. We can help you make the most of your pension and mix it with other income.

What are the key considerations for aged care planning?

As we get older, we might need care services. Look into different options like living in a care home, getting care at home, or community services. Include these costs in your retirement plans.

Why is estate planning important for retirees?

Estate planning is vital for protecting your assets and making sure they go where you want. Create wills and trusts, and use strategies to cut down on inheritance taxes.

How can I create reliable income streams for my retirement?

Enjoy your retirement with steady income streams. We can look into annuities and ways to use your super and pension benefits wisely.

What tax-effective investment strategies can I consider as a retiree?

Retirees can use tax-effective investment strategies to boost their income. We can guide you on investments and structures that minimise your taxes and increases your capital longevity.

How can working with financial professionals help me achieve financial independence in retirement?

Managing your wealth in retirement is crucial for keeping your lifestyle. Financial planners and advisors can ensure your retirement funds work well for your long-term goals.

What are some common retirement planning mistakes to avoid?

Avoid mistakes like not saving enough for super, not spreading your investments, and not planning for your estate. Knowing these errors can help you have a better retirement.

How often should I review and adjust my retirement plan?

Retirement planning needs regular checks and updates as things change and the financial world shifts. Set up regular reviews and adjust your plans to keep on track with your retirement dreams.