2022 the year in review

2022 The Year In Review

It’s often said you don’t realise how good something is until it’s gone.

This may apply to the low inflation environment that prevailed prior to the pandemic.

Apart from a few nasty interruptions this saw a downtrend in interest rates, mostly low unemployment, and an upwards trend in asset values.

The explosion in inflation over the last year and the associated surge in interest rates and slump in investment markets makes it all seem like a distant memory.

This has seen stocks having the worst year since the Global Financial Crisis. Furthermore, Sydney property prices are off over 12% for the year (and are no longer as safe as houses), with rising interest rates ultimately meaning buyers have a lower capacity to borrow and hence pay for homes meaning there will continue to be more constrained home prices.

Inflation was the keyword of 2022 and looks set to be the keyword for 2023 as well. With the Russian/ Ukraine war continuing top put pressure on global energy and food prices, China covid infections and lockdowns which will continue to disrupt supply chains, energy policies and food shortages are big factors we will start to hear more about in 2023, with all these factors having a significant impact on inflation, interest rates and investment markets around the globe.

A snapshot of the investment markets, illustrates that regardless of where your money was invested you were affected by rising inflation, rising rates and the uncertainty of the future.

Taking a dive into the investment space, it wasn’t a great year across the board:

Aussie Shares down -5.45%

International Shares down -19.44%

Residential property down -12.1%

Bitcoin down -62.49%

Australian Fixed Interest down -7.86%

International Fixed Interest down -11.80%

Cash up 3%

As illustrated, you couldn’t hide in 2022. Every asset class was hit and lost value, whether you were a conservative investor who had large holdings in bonds and fixed income or a speculative investor that still believed in the cryptocurrency craze, nobody was spared. Not even those that held cash as their income returns continued to get eroded away by rising inflation.

Furthermore, when we look at different risk tolerances we get a better picture of what many portfolios have returned over the past twelve months:

30% Growth Assets - Conservative Portfolio - down -11.35%

50% Growth Assets - Balanced Portfolio - down -13.38%

70% Growth Assets - Growth Portfolio - down - 13.45%

90% Growth Assets - High Growth Portfolio - down -14.14%

A strange year, that saw the more conservative portfolios lose almost as much capital value as the high growth portfolios in 2022. This is a direct result of rising interest rates and the impact this has on bonds/ fixed interest investments. However, as illustrated, by having further diversification across your portfolio this reduces your overall portfolio risk reducing the probability of losing significant amounts of capital.

Just as 2020 & 2021 were dominated by coronavirus so too was 2022. However, for differing reasons.

Governments around the world had their citizens locked up for large proportions of 2020/21, paying social security benefits, handing out money as support, spending a significant amount of money on health and vaccines, which has effectively created the inflationary environment we find ourselves in and are ultimately now paying for.

The big negatives of 2022 were of course dominated by inflation:

Inflation rose to the highest level in 40 years.

Energy prices – notably gas in Europe – surged as a result of energy shortages. In the US gas prices were up 60%, UK gas prices increased by 80%

Bond prices declined as interest rates rose, whilst bond yields continued to rise.

Chinese growth slowed sharply as a result of covid lockdowns, and is set to continue as covid continues to run rampant

Australian Property prices fell, with rising interest rates lowering the borrowing capacity of purchasers, which has managed to constrain property prices.

And there was plenty to distract long term investors with crypto, crypto platforms and the associated frauds, tech stocks which were the darlings of the investment world over the past three years (NASDAQ fell -33% over the past twelve months) and several scams that our clients brought to our attention over the past year including Gold and forex investment schemes that guarantee 10% per month returns. We have seen it all before though, but cryptos (or rather blockchain) remind us that technology is a regular disruptor, there is lots of surplus cash in the system & many are happy to speculate.

03/01/23 - news.com.au

THE OUTLOOK FOR 2023

First the bad news

Uncertainty remains around inflation and whether it has peaked or not.

Many experts were of the view that it had peaked and were showing early signs of tapering off, however the last two weeks in China will adversely affect these outlooks. As the supply chains around the globe will start to clog up again, with the virus running rampant in China, coupled with the the Chinese New Year holidays, will see a good two - three months of limited output from China.

source: 03/01/2023 news.com.au

Our Newcastle Financial Planners, like many financial experts, had the RBA making one more 0.25% rate increase in February before pausing until the end of 2023 when inflation is under control and the pain on the streets of Australia is too significant that they start to cut rates. However, the news out of China over the past two weeks has thrown another spanner in the works and may have a greater impact on our direction then many experts have verbalised.

Furthermore, rising interest rates coupled with falling home equity values will start to hit the confidence of households, especially when the credit card bills start rolling in after Christmas. Couple this with another interest rate rise in the first week of February and we could start to see many more Australians start to feel the pain. This may see property prices fall further, with many experts predicting another 5-10% fall.

In addition, we have seen over the past 20-30 years many households use the equity in their home as an ATM to pay for holidays, cars and home renovations. We will start to see this discretionary spending dry up in the coming months as everyone starts to realise the situation we are in and start to tighten the belt.

The other factor that will cause further pain will be the rise in unemployment. We have seen a sustained record low unemployment levels. However, with rising interest rates, consumer spending falling and rising costs, businesses will be looking to reduce costs, including reducing headcount. There will be a new wave of redundancies that come through in the new year, which will put further pressure on households. In 2023 the power will shift from the employee back to the employer, which may place downward pressure on wages.

In relation to the investment markets around the world, many experts believe that the markets have not “priced in” a recession. This means that businesses listed on stock exchanges around the world have not adjusted their future earnings (and subsequent valuations) to include the slow down in growth or a recession. However, as the future earnings continue to be delayed, many experts are now starting to take the view that 2023 will be a year where earnings are declining, however they will rebound in 2024, and markets may look through that. With many experts pointing to the history of stocks bottoming before earnings estimates bottom.

Inflation Implications

The collapse in inflation from the 1980s provided a tailwind for investment returns relative to what nominal growth and investment yields would normally indicate because it meant: lower interest rates; reduced economic volatility and uncertainty (and hence lower risk premiums); and a higher quality of company earnings. For growth assets it meant a valuation boost as shares traded on higher price to earnings multiples and real assets like property traded on lower income yields.

Higher inflation over the medium term than in the pre-pandemic period will remove this tailwind and threaten its reversal:

Higher interest rates will make cash and fixed interest relatively more attractive to investors.

Price to earnings ratios on shares will likely settle at lower levels and income yields on real assets at higher levels.

Higher mortgage rates will mean a lower capacity to borrow and hence pay for homes meaning more constrained home prices.

If inflation averages around central bank targets, which is our base case, returns will be constrained but still reasonable. If alternatively, inflation turns out much higher then returns risk being weak. Which makes it very important central banks are successful in keeping inflation down – it’s just that the structural backdrop means it will likely be harder going forward.

Optimism

However, there is good reason for optimism about continuing economic recovery in the year ahead.

Inflation starting to come under control (has it peaked yet?). Many experts expect inflation will continue on a downward trend as global demand slows. This should allow central banks to eventually change direction and may set the scene for the next economic upswing.

Large amounts of equity within homes - which will provide some buffer, opportunity and choices for many Australians.

We are at the very end of the rate rise cycle. There will be light at the end of the tunnel.

There is still a housing shortage in Australia (despite the short term metrics)

Once earning forecasts are revised to reflect the current economic climate, we will see further growth for those companies that have low debt and large cashflows.

Higher interest rates will make cash and fixed interest investments more attractive.

There will be plenty of opportunity for investors in 2023, whether this is property (commercial or residential), shares, term deposits, annuities, and even small business.

IMPLICATIONS FOR INVESTORS

Global shares

Equities have a limited upside with recession risk on the horizon as the Fed continue to raise rates into restrictive territory.

As many experts believe the recession isn’t fully reflected in corporate earnings expectations or valuations.

However, as previously mentioned, if earning expectations can be looked through, we may see some optimism return towards the latter half of the year.

Australian shares

Australians better economic outlook has already been priced into equities, which limits the upside.

Australia will still better from rising energy and commodities prices which should prop up the market.

Australian homes

Australian house prices will continue to fall for the first half of the year. This will provide a perfect opportunity for first home buyers and investors, before more optimism returns to the property market towards the end of 2023.

Fixed Income

With interest rate rises slowing (and in some cases stopping), fixed income will make a comeback after experiencing the worst year of returns in 2022.

Cash and bank deposits

Are starting to look more attractive, especially for those that are retiring or that have retired. We are getting 4-5% returns for 1-3 year terms, which is a large proportion of retirees returns that they are looking for. We will see an increase in these allocations as we look to reduce the overall risk of many retiree portfolios.

Bitcoin

Could it be the year that crypto explodes and is spoken about as the greatest ponzi scheme in history?

SUMMARY OF INVESTMENT OUTLOOK

With all that being said, the goal of any investor is the highest possible returns.

But we believe the blind pursuit of outperformance isn’t always the way to deliver a goal.

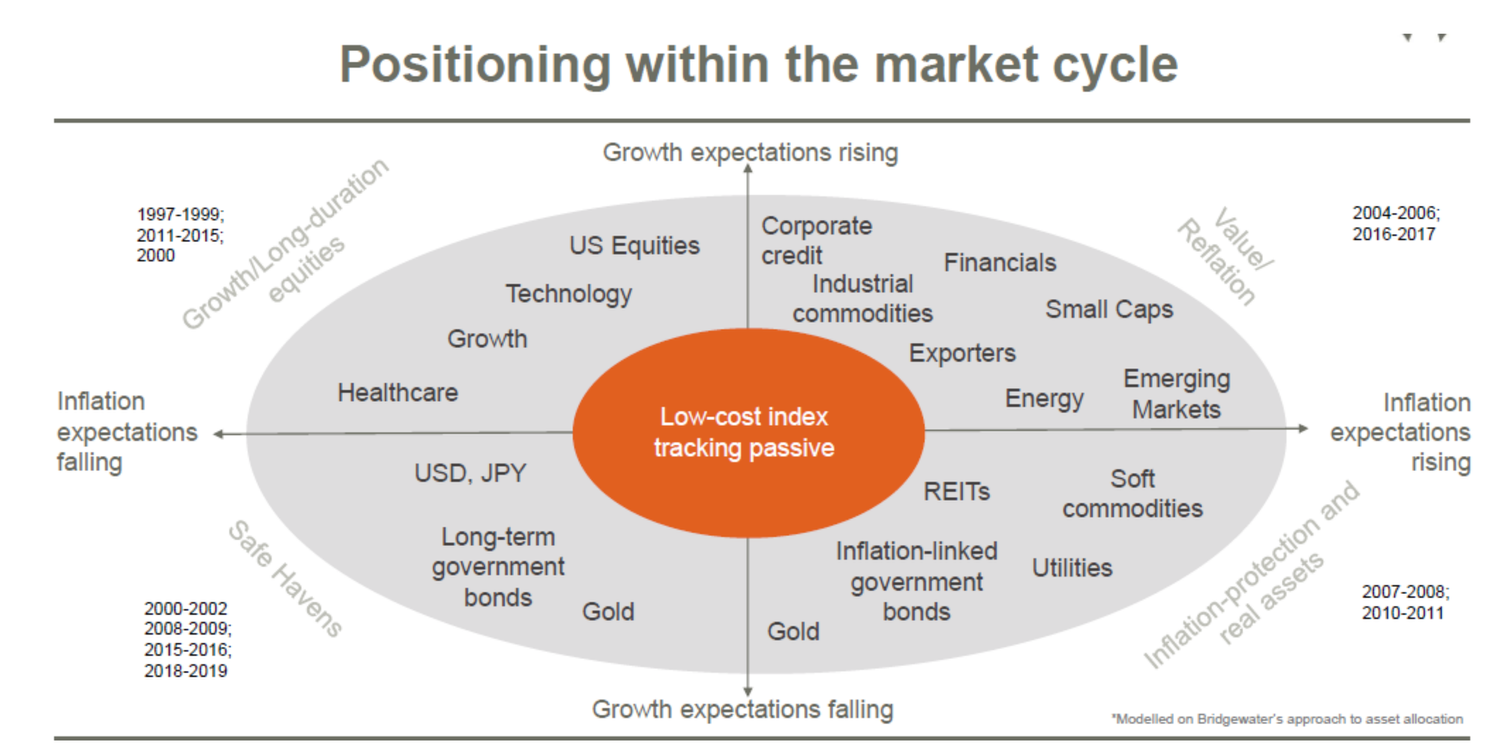

The chances of getting assessments/ predictions right at this stage remain problematic, so diversification and risk management are key (as illustrated by the returns of a diversified portfolio). .

We believe maximising returns over time is about getting the balance right between opportunity and defence. That’s why our investment philosophy is built around an agile process of understanding and capitalising on investment opportunities while also managing risks, both known and unknown.

NEWCASTLE ADVISORS YEAR IN REVIEW

Despite the volatility and uncertainty, there were still a number of highlights for 2022:

We supported so many new families that we welcome to our community.

We have supported many people retire this year, that will not be returning to work after the Christmas holidays, instead having their income replaced allowing them to enjoy time with their families and loved ones.

We have supported several clients make the complex seem simple (plans and options for those disabled, suffering from mental health, and moving loved ones into care).

We have been in our premises in Warners Bay for twelve months, securing our long term future.

We have some ambitious goals this year, that we would love your support with:

Opening our books to help more people each month.

Being more accessible

Building our team to increase our capacity to help support more people.

If you have any friends or family that may benefit from our financial advice, whether they are starting out, looking to get ahead or considering retirement, please reach out as we would love to support them.

UPDATE FROM MATT

2022 was a huge year for our family.

My wife, Bec is pregnant with our second child, whom is due in February.

Harry (2.5 years old) started swimming, talking and letting us know what he really thought. It has been unbelievable to watch his cheeky personality grow.

We have been in our forever home for 12 months, which we have been able to finally enjoy the pool with the warmer weather.

For our existing clients, we will be in contact in January to arrange a time to see you in the first quarter of the year.

We will look to re-set your goals for the year, update your financial position, and realign your investment portfolios to ensure you are positioned to take full advantage of the opportunities when they arise.

However, as always, if there is something more pressing, please do not hesitate to contact me personally on 0410 581 424 or mmccabe@newcastleadvisor.com to arrange a phone call, zoom meeting or face to face appointment.

Thank you for your continued support and we wish you & your family nothing but health, wealth and happiness for 2023.

Matt McCabe

Director/ Financial Advisor

Newcastle Financial Advisors

Meet The Author

Matthew McCabe

Matthew McCabe is an expert financial planner who has been in the financial services industry for over 18 years. He specialises in supporting everyday Australians retire on their terms by making the complex seem simple.

Matthew is the founder of Newcastle Advisors, an organisation that is dedicated to empowering individuals through financial literacy and education, to ensure Australians have the tools and information to make an informed decision about their financial future.

Matthew has also been a finance expert contributor to the Newcastle Herald, Channel 7 News, Canberra Times, Starts at 60 and Hunter Headline.

Investment Banks Market Outlooks

Goldman Sachs https://lnkd.in/eKzF_2K4

J.P. Morgan https://lnkd.in/eHb6-622

Morgan Stanley https://lnkd.in/e2nAMjmM

Bank of America https://lnkd.in/e8XFD8TW

BlackRock https://lnkd.in/eYxCBRGj

HSBC https://lnkd.in/eNfBiJvH

Barclays https://lnkd.in/eRT4dsFY.

NatWest https://lnkd.in/euftbUw6

Citi https://lnkd.in/eXwA-Y4X

UBS https://lnkd.in/exudCU6V

Credit Suisse https://lnkd.in/e4CEK5NZ

BNP Paribas https://lnkd.in/ec4hWEdm

Deutsche Bank https://lnkd.in/eAWCSV_7

ING https://lnkd.in/eNpdmVH8

Apollo Global Management, Inc. https://lnkd.in/ewwq_62M

Wells Fargo https://lnkd.in/euMkQnKE

BNY Mellon https://lnkd.in/ezMfVgND

Fidelity International https://lnkd.in/eJwK6tVx

Lazard https://lnkd.in/eku-xhqp