What the Federal Budget means for you?

Summary of 2021 Federal Budget

Last night’s Federal Budget contained a number of proposals that may impact your personal financial plan.

Should you have any questions on how this announcements affect your personal plan, please contact your Newcastle & Lake Macquarie Financial Planning Advisor.

The commentary below is our financial planner’s initial observations and interpretation of the proposals based on the limited details provided in the Budget papers and fact sheets.

Importantly, please remember that these proposals require passage of legislation before they are implemented.

Superannuation

Repealing the work test for non-concessional and salary sacrificed contributions

Proposed effective date: 1 July 2022

Currently, individuals aged 67 to 74 years can only make voluntary contributions to their superannuation, or receive contributions from their spouse, if they meet the ‘work test’, (i.e. have worked at least 40 hours over a 30 consecutive day period in the relevant financial year) or are eligible to contribute under the recent retiree work test exemption.

From 1 July 2022, the Government will allow individuals aged 67 to 74 (inclusive) to make or receive non-concessional superannuation contributions or salary sacrificed contributions without meeting the work test, subject to existing contribution caps. These individuals will also be able to access the non-concessional bring forward arrangement, subject to meeting the relevant eligibility criteria. The work test will still have to be met by individuals aged 67 to 74 years wanting to make personal deductible contributions.

Observation:

Removing the requirement to meet the work test when making non-concessional or salary sacrifice contributions will simplify the rules governing superannuation contributions and will increase flexibility for older Australians to save for their retirement through superannuation.

Extending access to downsizer contributions

Proposed effective date: 1 July 2022

Currently, downsizer contributions to super can only be made by individuals age 65 or older. The Government is proposing to lower this age from 65 to age 60. All other eligibility criteria for downsizer contributions remains unchanged.

Observation:

It should be remembered that downsizer contributions do not count toward an individual’s non-concessional contribution (NCC) cap. Individuals under age 65 may also be able to trigger a 3-year bring-forward NCC cap subject to their Total Superannuation Balance. This could potentially result in super contributions of up to $630,000 being made by an individual when combining their NCC cap and a downsizer contribution (where eligible to do so).

Superannuation Guarantee (SG) - Abolishing the $450 per month income threshold

Proposed effective date: 1 July 2022

The current $450 per month minimum income threshold before SG contributions become payable will be removed.

Observation:

This means employees at all income levels will receive SG contributions.

Note: The SG rate is currently legislated to increase to 10% from 1 July 2021 and incrementally to 12% in following years. This remains unchanged.

Relaxing residency requirements for SMSFs

Proposed effective date: 1 July 2022

The Government is proposing to relax the residency requirements for self-managed superannuation funds (SMSFs) by:

• Extending the central management and control test safe harbour from two to five years for SMSFs, and

• Removing the active member test for both SMSFs.

Observation:

These measures would provide SMSF members with greater flexibility to retain, and continue to contribute to, their existing fund while being temporarily overseas.

Taxation – Personal

Extending the Low and Middle Income Tax Offset (LMITO)

Proposed effective date: 1 July 2021

The Low and Middle Income Tax Offset (LMITO), which was due to end on 30 June 2021 will now be retained for one more year in 2021-22. It is worth up to $1,080 for individuals or $2,160 for dual income couples. Consistent with current arrangements, the LMITO will be received on assessment after individuals lodge their tax returns for the 2021-22 income year.

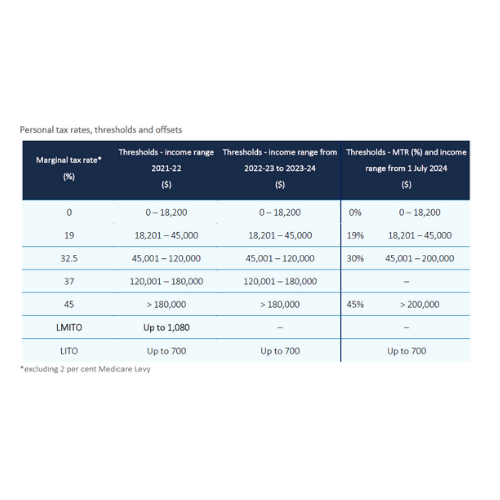

The table below summarises the personal tax scales to apply in 2021-22 onwards including both the Low Income Tax Offset (LITO) and LMITO.

Increasing the Medicare Levy low-income thresholds

Proposed effective date: From 2020-21 financial year

The Medicare levy low-income thresholds for singles, families, and seniors and pensioners is to be increased effective from 1 July 2020 so that low-income taxpayers generally continue to be exempt from paying the Medicare levy.

The threshold for:

• Singles, will be increased from $22,801 to $23,226,

• Families, will be increased from $38,474 to $39,167,

• Single seniors and pensioners, will be increased from $36,056 to $36,705, and

• Families (seniors and pensioners) will be increased from $50,191 to $51,094.

For each dependent child or student, the family income thresholds increase by a further $3,597.

Housing affordability

Extending the First Home Super Saver Scheme (FHSSS)

Proposed effective date: 1 July 2022

The Government has announced that the cap on withdrawals of voluntary contributions from the FHSSS will be increased to a maximum of $50,000 plus notional earnings per eligible person. Withdrawals are currently capped at a maximum of $30,000 plus notional earnings per person. The FHSSS is a scheme aimed at boosting the deposit savings of first home buyers by allowing them to use the tax advantaged superannuation system, in addition to traditional non-super vehicles such as bank savings accounts. The FHSSS allows first home buyers to withdraw voluntary contributions (both concessional and non-concessional) plus an amount of notional earnings towards their first home purchase. The withdrawal cap of $15,000 voluntary contributions per financial year remains. Some other technical amendments in relation to amending instructions for withdrawn amounts will also be made.

Extending the First Home Loan Deposit Scheme (FHLDS)

Proposed effective date: 1 July 2021

The Government has announced that an additional 10,000 places will be made available in the FHLDS (New Homes). The new places will be available in the 2021-22 year. The extension of the FHLDS will apply to first home buyers who buy a newly constructed home or who build a new home.

The FHLDS allows first home buyers/builders to borrow more than the standard 80% of the property’s value with only a 5% deposit, with the balance (15%) being underwritten by a government agency in the event of loan default and shortfall. The FHLDS allows eligible first home buyers to borrow more without paying the premium for Lender’s Mortgage Insurance which would otherwise apply in such situations.

Application for a place in the scheme is made by participating lenders on behalf of the borrowers when the borrowers make their loan application.

Other housing related proposals

HomeBuilder program –

the Government will extend the construction commencement requirement under this existing program from the existing 6 to 18 months.

Family Home Guarantee scheme –

the Government will establish a program similar to the FHLDS above to allow eligible single parents with dependants to enter or re-enter the housing market with a deposit as little as 2%. The scheme will have 10,000 places and be available from 2021-22.

It is important that you understand these changes and how this affects your financial plan.

Should you have any questions, please do not hesitate to contact your Newcastle & Lake Macquarie Financial Planning Advisors who can guide you through the proposals.

Source:

https://budget.gov.au/

https://budget.gov.au/2021-22/content/factsheets/index.htm

https://au.finance.yahoo.com/news/huge-superannuation-changes-in-federal-budget-101131249.html

https://www.news.com.au/finance/economy/federal-budget/heres-your-fiveminute-guide-to-the-budget/news-story/daa547d2264a01877cdb08b1dfdbeef8

https://www.amp.com.au/insights/grow-my-wealth/2021-22-federal-budget-roundup